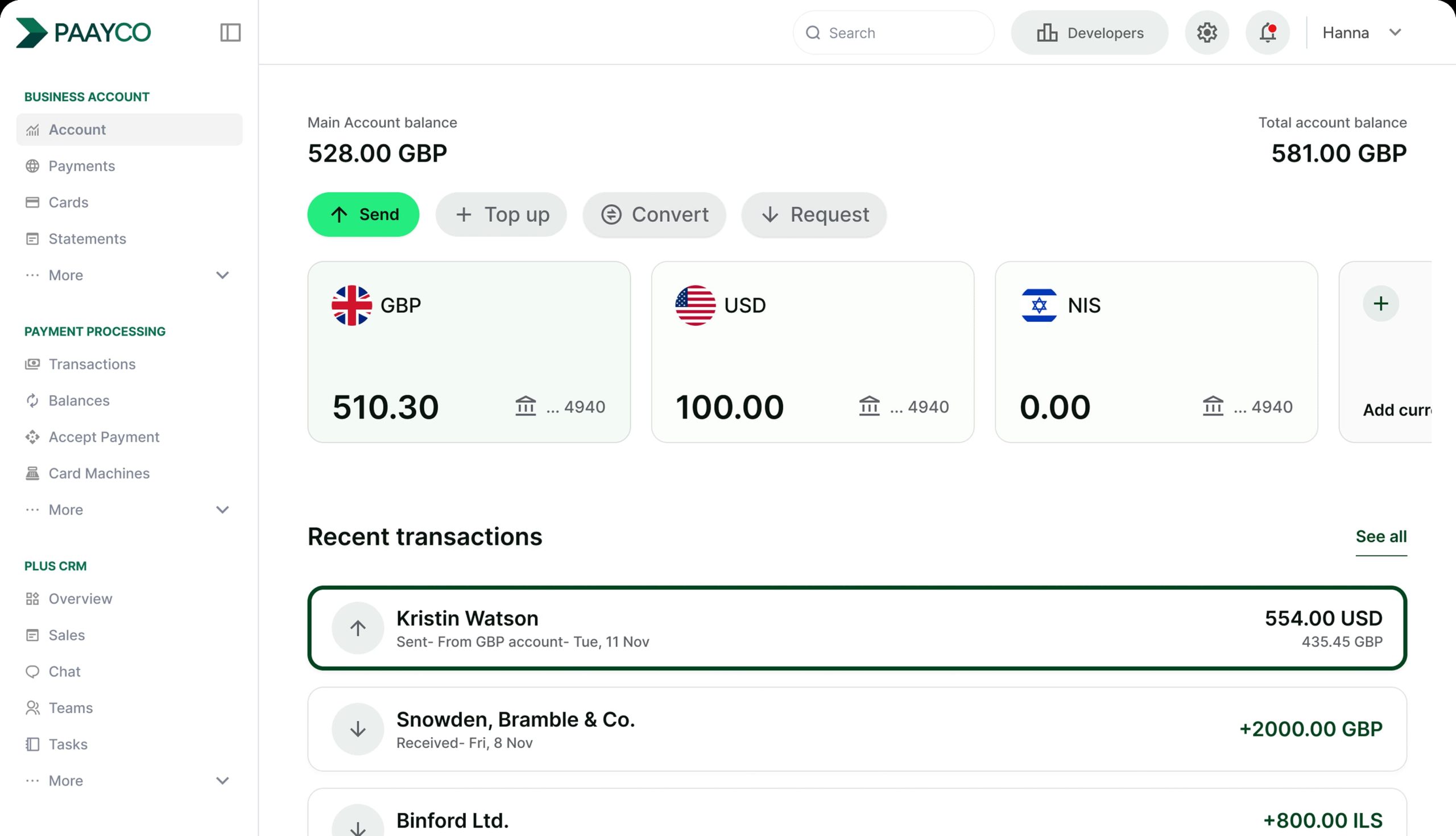

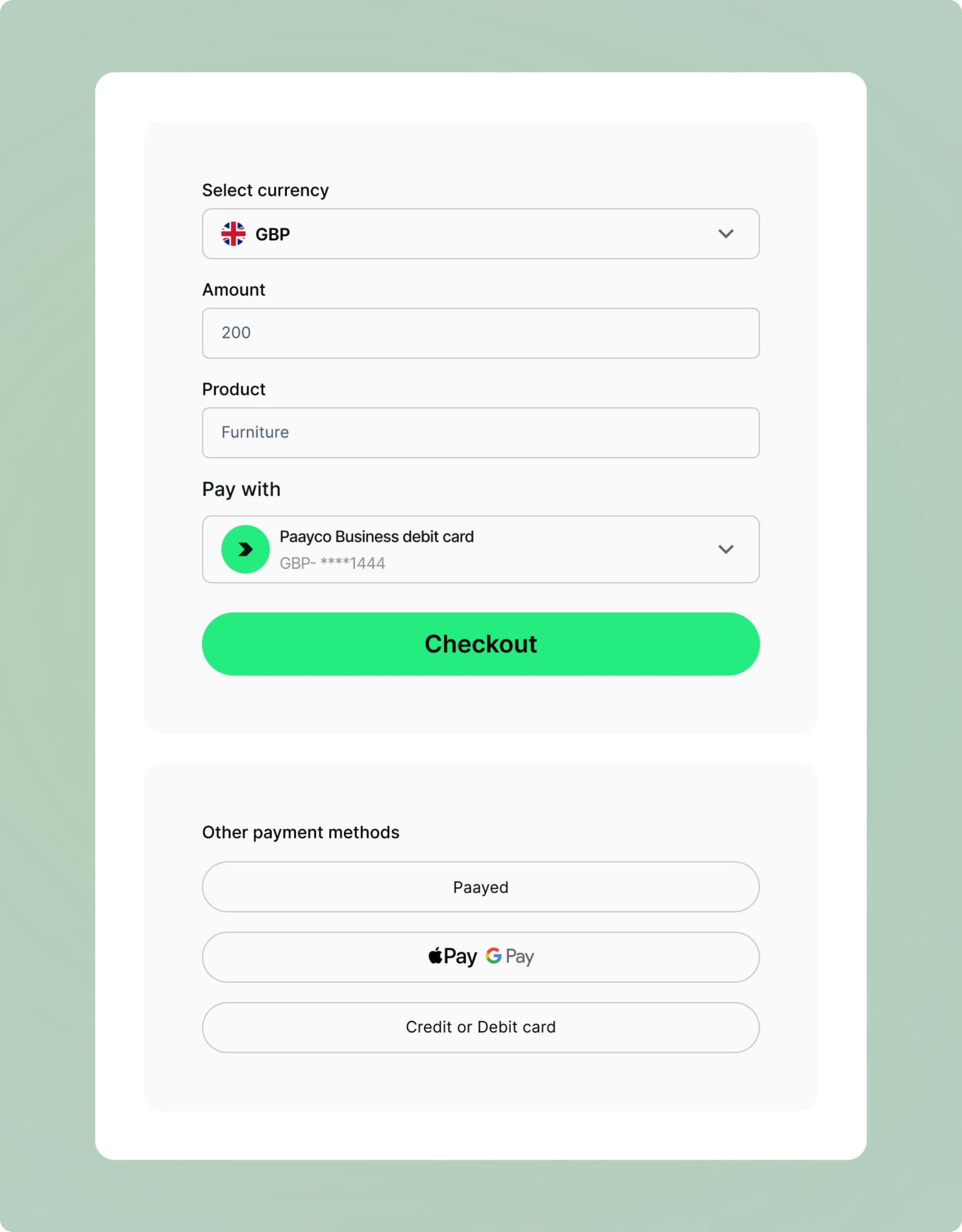

Provide your team with business debit cards for international use, eliminating foreign currency transaction fees. Establish individual spending limits for each card, and enjoy a 0.5% cash back reward on all purchases.

Our organization has achieved compliance with both the Payment Card Industry Data Security Standard (PCI DSS) - specifically focused on protecting credit card data - and the International Organization for Standardization (ISO) 27001 standard.

We securely store your money with reputable financial institutions, keeping it separate from our own accounts, and it remains inaccessible to our partners during the normal course of business.

The Financial Services Compensation Scheme (FSCS) is the UK's statutory compensation scheme for customers of UK authorised financial services firms and protects up to £85,000 per person, per financial institution.

Safeguarding is used by Payment Institutions and E-Money Issuers to protect funds it holds in-trust for the beneficial use of underlying users in the event they were to go into liquidation. It ensures that the funds can only be used to complete the payment as instructed or, should that prove to be impossible, the funds are returned to the original payer.